Insight: BookingBug Research reveals UK banks lag behind rest of the high street

Posted by

- Mystery shoppers reveal UK banks have a long way to go

- Large queues, under equipped staff and mismatched marketing to blame

- The UK’s largest banks including HSBC and RBS were the furthest behind

BookingBug releases the first ever research into how the top 10 retail banks are creating a more competitive customer experience, and whether they are keeping up with the rest of the high street.

BookingBug releases the first ever research into how the top 10 retail banks are creating a more competitive customer experience, and whether they are keeping up with the rest of the high street.

In a landscape transformed by clever omnichannel strategies and added value services, banks have received relatively little scrutiny compared to their retail siblings.

Sending mystery shoppers out to the branches, websites and call centres of each major bank, they were ranked on the marketing, attitude, accessibility and delivery of in-store services.

Findings of the Retail Banking Service Index include:

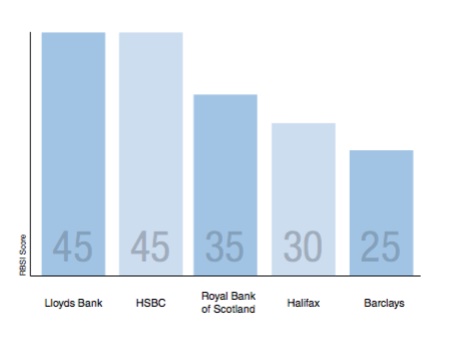

- The largest banks have the most work to do: Lloyds TSB, HSBC, RBS, Halifax, Nationwide and Barclays all scored less than 50% of the points on offer

- The human element was still missing: The mystery shoppers were not greeted when entering 9/10 of the banks. Only Metro Bank utilised a ‘concierge’ style approach, but they still had no information on the customers coming into branches.

- Retail banks trail behind the rest of the high street: Six out of ten banks examined took 50% or less of the points on offer. By contrast, when BookingBug looked at ordinary high street retailers in a similar report last year, every member of the top ten scored over 70%

BookingBug’s CEO, Glenn Shoosmith, has witnessed much of this first hand in conversation with these banks:

“The divide between the transactional and relational side of banking is widening every day. From a surprisingly efficient ATM experience to in-depth advice on some of life’s biggest decisions, banks are being pulled in every direction and must make difficult choices about how to prioritise their response.”

“The change has started — but our research shows it is unevenly spread across the main players. The banks who embrace this opportunity first will build loyalty around their most valuable products, and keep their customers attention for complementary accounts and services.”

Additional findings

Additional findings

- Different providers prioritise different challenges

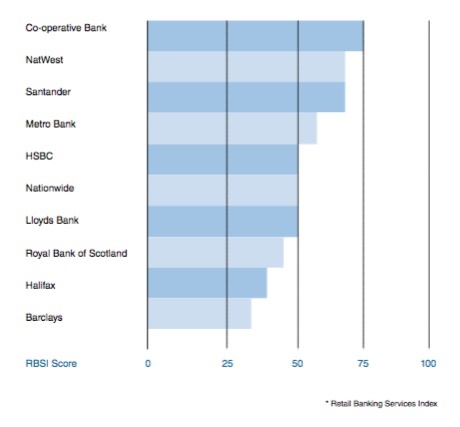

NatWest and The Co-operative Bank led the scoreboard — but for starkly different reasons.

NatWest excelled in branch design, creating spaces that sent clear messages about the importance of services. The Co-operative Bank was a leap ahead with a booking system that connects the customer experience across every channel.

This asynchronous comparison makes it clear there are actually dozens of smaller battles being fought simultaneously, in the journey to become truly proficient in omnichannel.

- Staff are limited by the platforms that support them

In almost every case, staff manning the information desks had no access to advance information on who customers were and why they were there

Even with charming and charismatic service, there’s no replacement for a joined up approach where employees can immediately identify valuable customers and get them to the right experts on duty.

- Customer expectations are rising faster than ever

From our visits, it’s obvious that there are many moving parts to the experience in modern banks. They still need a great ATM experience, but they also need staff who can provide an amazing personal service and assist customers through these channels.

With queues for ATMs as well as information desks in branches, it seems customers want every service available everywhere. This means instead of focus, banks are being pulled in every direction — and must make difficult choices about how to prioritise their response.